Purchasing a property

Your Guide to Seamless Property Purchases: From Dream to Reality

3 Stage EW Method

Stage 1 (Preparation): 1 on 1 meet up or Zoom call to understand your requirements

The first stage of the three-stage EW process is preparation. The first stage involves three key steps. Firstly, we identify the goals, including the number of properties and desired outcome. Secondly, we evaluate the client's financial position by assessing income, expenses, debt, assets, and liabilities. Lastly, creating a personalized action plan that outlines the necessary steps to achieve investment goals within the desired timeframe. This stage sets the foundation for a successful property purchase journey.

Step 2 (Implementation)

The second stage of the three-stage Property Purchase process is implementation. This stage involves three crucial steps. Firstly, gaining a comprehensive understanding of risks and property knowledge. Secondly, conducting thorough property research to identify potential investment properties aligned with the client's goals, budget, and risk tolerance. Lastly, analyzing each property to assess its potential return on investment, cash flow, and risks. This stage allows for informed decision-making and paves the way for successful property acquisitions

Step 3 (Optimization)

The third stage of the three-stage Property Purchase process is optimization. This stage involves three key steps. Firstly, property acquisition, where identified properties meeting investment criteria are purchased as per the action plan. Secondly, property management entails activities such as finding tenants, rent collection, and property maintenance to maximize returns. Lastly, portfolio optimization involves continuous monitoring and adjustments to the investment portfolio, identifying opportunities for long-term benefits. This stage ensures the overall success and growth of the property investment journey.

Are you ready to unlock your path of financial freedom ?

The 3-stage EW (Property Purchase) method is a proven framework that has led to significant success for many families. By following this structured approach consisting of 9 steps, nearly 200 families have successfully upgraded to private properties. Some have even managed to purchase two private properties within five years while effectively managing their financial obligations. This method has enabled individuals to retire at least 10 years earlier, showcasing its effectiveness in achieving property ownership and financial goals.

Sell Your Property with Confidence

Your Guide to Seamless Property Purchases: From Dream to Reality

Solving Your Housing Concerns: Expert Guidance Every Step of the Way

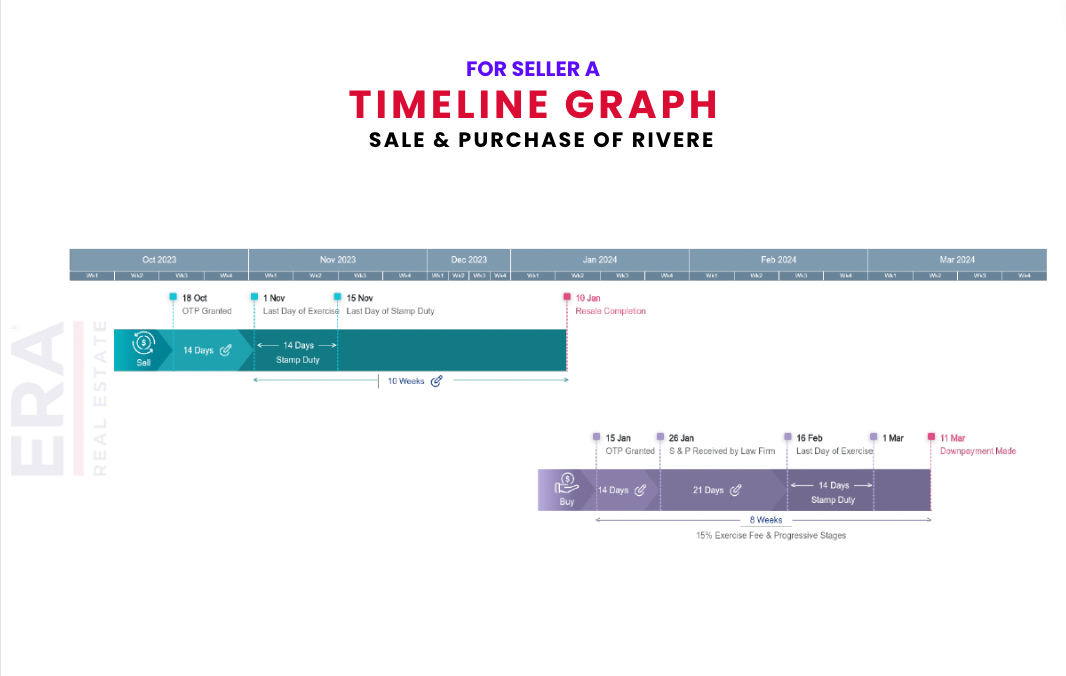

Finding a new home after selling your current one can be overwhelming. The uncertainty of where to stay and how to fund your new property can create significant stress. We understand your worries completely. With our wealth of experience, we prioritize ensuring you always have a stable living situation throughout this process.

Rest assured, we're here to guide you through every step, helping you understand the timelines involved. Our solutions are customized to meet your specific needs, providing you with the security of a roof over your head. Below, we provide a detailed example of how we create personalized timelines for our clients, tailored to their unique situations. We're dedicated to making your transition smooth and worry-free.

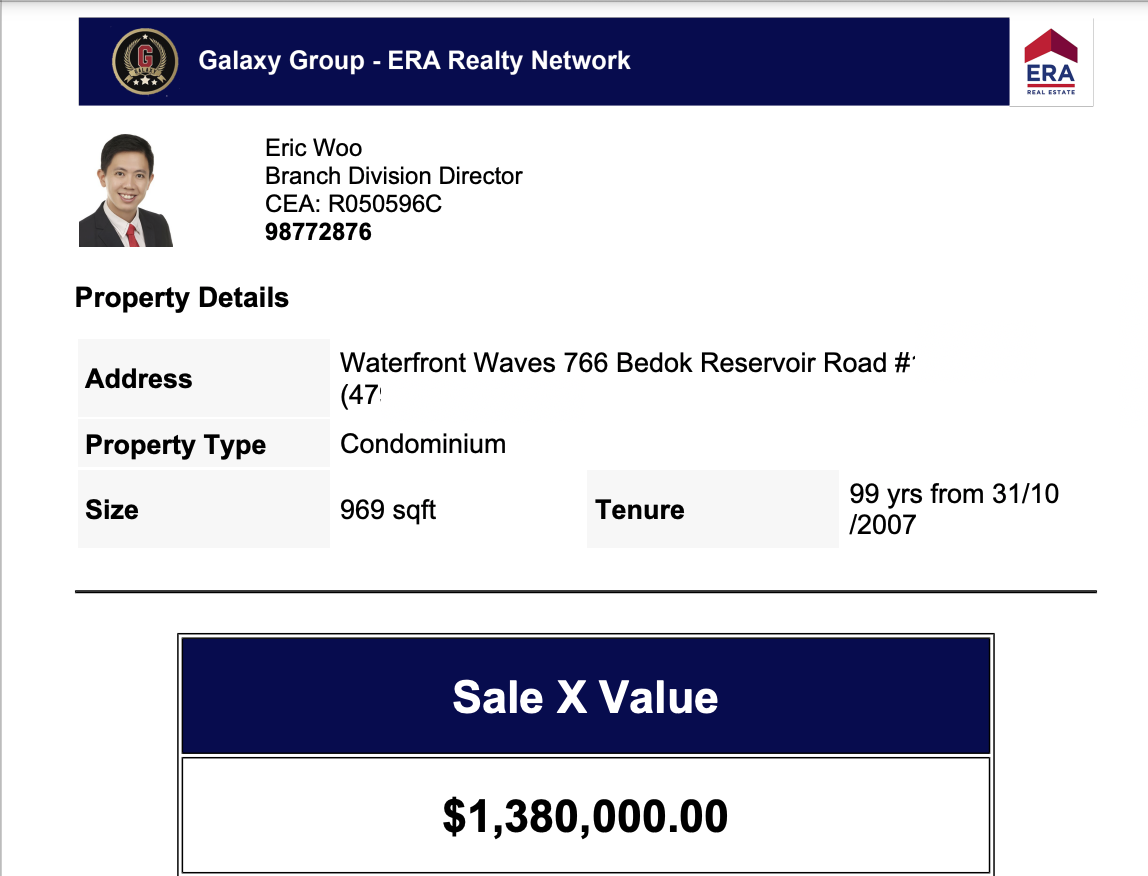

Empowering Your Decision-Making: Comprehensive Property Analysis Tailored to You

Prepare for an in-depth Home Analysis tailored just for you, offering valuable insights into current market trends and up to 5 bank valuations. We delve into your neighborhood's past transactions and analyze competitors' prices, enabling us to set benchmarks and exceed limits with our customized approach.

Rest assured, we prioritize your confidence. We equip you with all essential data, ensuring you're comfortable every step of the way before we proceed further. Your property journey starts with knowledge and assurance.

Visual Storytelling: Elevating Your Property Experience

In today's fast-paced real estate market, captivating visuals are paramount. Online listings are the first impression potential buyers have, making visual storytelling crucial. A single photograph can convey a property's charm and potential in ways words cannot.

Consider this example: a property, previously stagnant for over 6 months under Agent A's marketing, was sold within a month after we took over. Our approach is proactive. We create immersive POV walkthrough videos, offering a realistic preview of the property. Our Home Tour videos provide insights into the locale, amenities, and ambiance, enhancing buyers' understanding.

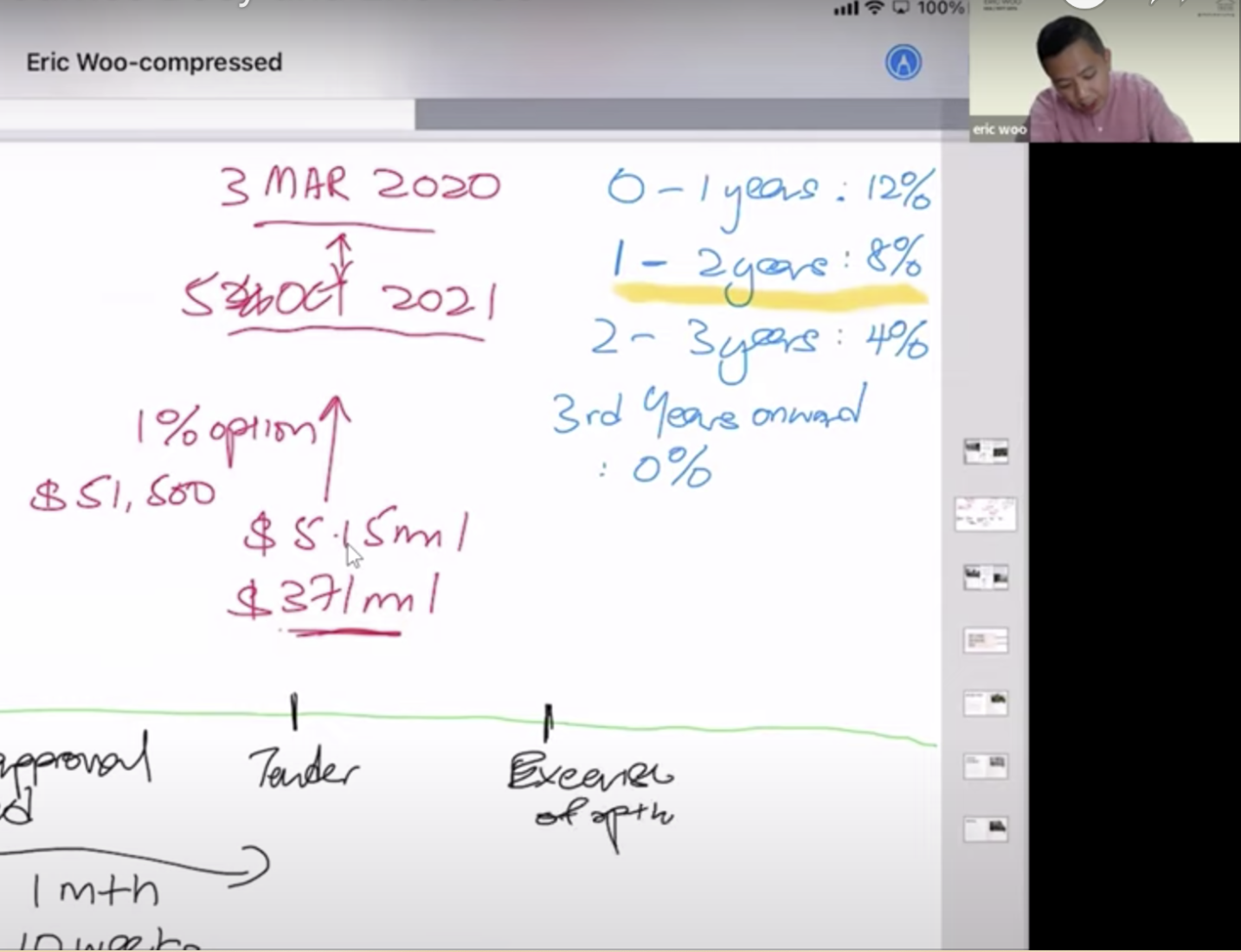

How Does ABSD impact you?

A Singaporean couple, are looking to buy a second property valued at $1 million. They are worried about the Additional Buyer's Stamp Duty (ABSD). In Singapore, when purchasing a second residential property, Singaporeans need to pay 20% ABSD on the property's purchase price.

ABSD Concern: They are worried about the Additional Buyer's Stamp Duty (ABSD). In Singapore, when purchasing a second residential property, Singaporeans need to pay 20% ABSD on the property's purchase price.

Calculation: For their $1 million property, the ABSD would amount to $200,000 (20% of $1 million). This is an additional cost they need to consider in their budget.

Contact our experts to discover potential strategies for reducing or avoiding ABSD!

Decoupling

Decoupling refers to the procedure where one of the co-owners of a property transfers their ownership share to the other co-owner, typically occurring in situations where a property is jointly owned by two individuals. This means they can buy another property without having to pay Additional Buyer's Stamp Duty (ABSD).

This process involves the person buying all the remaining shares of the property from their partner. A legal agreement, known as the sale and purchase (S&P) agreement, outlines all the details. A lawyer or conveyancer usually drafts this agreement.

To complete the process, the buyer pays the seller for their share of the property as stated in the S&P agreement and also pays the Buyer's Stamp Duty (BSD) to the Inland Revenue Authority of Singapore. The proceeds are used to settle any existing mortgages, CPF (Central Provident Fund) used, and Seller's Stamp Duty (SSD) before transferring ownership to the buyer.

Trust Purchase

Parents can buy property for their children below 21 years old and hold it in trust, allowing the child to own the property. This is often used for tax planning and inheritance purposes. Buying property through trusts usually requires substantial cash. It's a choice for those with significant financial resources aiming for inheritance or tax planning.

Steps to Buy Property in Trust:

- Set up a trust with a trust deed, clearly defining beneficiaries, trustees, powers, and beneficial interest.

- Property in trusts must be fully paid in cash; CPF funds and bank loans cannot be used.

ABSD (Trust) Impact: The Singapore government imposed a 65% Additional Buyer's Stamp Duty (ABSD) on residential property transfers into living trusts. Trustee can seek a refund from IRAS if conditions like identifiable beneficiaries and irrevocable trusts are met. The refund is based on the difference between the 65% ABSD rate and the applicable ABSD rate for the beneficiary with the highest rate.

Case 1: Couple owns 2 properties. Buying 3rd property

The Singaporean couple, each owning a private property, desired a 2-bedroom home in Woodleigh. With our expert guidance, they utilized a loan against their existing properties. The strategic move involved purchasing the new property under a trust for his son. This not only secured them a private property in an ideal location but also resulted in substantial tax savings. Our professional advice made their dream home a reality while optimizing their financial strategy.

Today, the family owns 3 properties in Singapore

Case 2: Owners of EC purchase 2nd private property

Mr. and Mrs. Tan currently owns an Executive Condominium (EC) in Tampines and were interested in acquiring another private property. Mrs. Tan, is not keen to sell their current EC and aimed to minimize incurring Additional Buyer Stamp Duty (ABSD).

During our consultation, we carefully evaluated their financial standing and took the time to understand their specific needs and goals. Subsequently, we provided them with a comprehensive overview of market trends, data analysis, potential opportunities, and crucially, an assessment of risks and safety measures.

After our discussion, Mr. and Mrs. Tan gained confidence in their decision. They opted for a strategy that involved decoupling their existing property while simultaneously purchasing their next private property.

Today, Mr and Mrs Tan own 2 private properties

ENG

ENG